Industry Insights

A CRA Member Exclusive: Top Title

A CRA Member Exclusive

These valuable resources are an exclusive benefit for California Restaurant Association Members. If you are interested in becoming a member click here to join or to have a Member Development Manager reach out to you directly.

Websites become new battleground in litigation trend hitting restaurant industry

Created: 2025

Restaurants have found themselves in the crosshairs of a nascent legal strategy targeting their use of commonplace…

A Guide to California’s Proposition 65

Last Updated/Reviewed: 08.28.2025

What’s New: This Industry Insight was updated to include information regarding Bisphenol S (“BPS”).

Preparing for AB 1228

Published: 2024

Effective April 1, 2024, AB 1228 will usher in sweeping changes for the California Fast Casual Restaurant industry, including a minimum wage hike to…

ADA Compliance for Websites

Last Updated/Reviewed: 2025

The Americans with Disabilities Act (ADA) generally requires that businesses provide qualified individuals…

California Consumer Privacy Act (CCPA) and California Privacy Rights Act (CPRA)

Last Updated/Reviewed: 2023

In 2018, California enacted the CCPA which is the first comprehensive consumer privacy statute in…

California’s Indoor Heat Illness Prevention standards: 6 Essential Requirements for Employers

Last Updated/Reviewed: 2025

Cal/OSHA has recently adopted Indoor Heat Illness Prevention standards. (California Code of Regulations, title 8, section 3396). These…

California’s Paid Sick Leave Law

Last Updated/Reviewed: 2025

California workers are covered by regular CA Paid Sick Leave laws and CA Paid Family Leave. All of which provide employees avenues to flexibly take time…

Cellular Telephones

Last Updated/Reviewed: 2024

While at work, we expect our employees to devote their full energy and attention to conducting company business. Receiving…

Defending a Title III ADA accessibility claim

New regulations, higher priorities assigned by the federal government and private litigants seeking worldwide compliance, means Title III under the…

Employment termination

Last Updated/Reviewed: 2024

Terminating an employment relationship is never easy. Many people fail to appreciate how personally and legally…

Employee Theft: Why do employees steal?

Employee theft in the workplace is a growing problem that affects many employers. Nearly 95 percent of all businesses suffer from theft…

Employees versus independent contractors

Last Updated/Reviewed: 2024

With limited exceptions, workers who perform services for a business are either employees or independent contractors. An independent contractor…

Employer-mandated tip pooling guidelines

Last Reviewed: 2026

Tips and their distribution among the staff have plagued the hospitality industry for years. Federal courts interpret the federal law differently…

Employment of minors

Last Updated/Reviewed: 2024

Passed and signed into law in late 2020, AB1963 established that “mandated reporters” now include certain supervisor and human resources…

Exempt versus non-exempt employees

Last Updated/Reviewed: 2024

Employees are either exempt or non-exempt. Exempt employees are exempt from many wage and hour requirements–most…

Federal menu labeling laws

Last Updated/Reviewed: 2026

This law applies to restaurants and similar retail food establishments that are part of a chain of 20 or more locations…

Guide to family, medical and pregnancy leave

Last Updated/Reviewed: 2024

Depending on their size, California employers are required to comply with several leave of absence laws, including the federal Family…

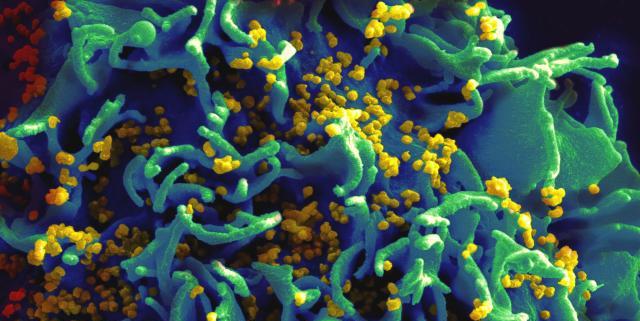

HIV and other infectious or communicable diseases

Last Updated/Reviewed: 2024

Since the California Restaurant Association (“CRA”) first published the report AIDS in the Workplace: Facts and Fears in 1985, the level of public

How to provide equal access for all

Last Updated/Reviewed: 2023

Service animals enrich the lives of many disabled Americans by performing vital tasks to increase their owners’ safety, mobility…

“Joint Employer” Liability for Franchisors and Restaurants in California

Last Updated/Reviewed: 2024

In 2018, Dynamex Operations West, Inc. v. Superior Court changed California’s legal landscape. Industries whose existence…

Legal restrictions on gift cards and certificates

Last Updated/Reviewed: 2025

Pursuant to Civil Code Section 1749.5, restaurant gift cards cannot have expiration dates or service…

Marijuana use in California restaurants

Last Updated/Reviewed: 2024

In 2016, Proposition 64, known as the Adult Use of Marijuana Act, effectively legalized the use of recreational marijuana…

Meal and rest period policies in California

Last Updated/Reviewed: 2025

Meal periods are required for every five consecutive hours worked and rest breaks are required for every…

Military leave: rights and responsibilities

Last Updated/Reviewed: 2025

Both state and federal laws protect employees who are serving on active duty in the military from losing any employment rights…

Minors and Bars: The Basics

Everyone knows that in California you must be 21 in order to consume alcoholic beverages. However, can someone under the age…

Music use and copyright law

Last Updated/Reviewed: 2024

Restaurant owners and operators are often caught off-guard when they receive a letter or phone call from a representative from a performing…

An overview of overtime laws

Last Updated/Reviewed: 2024

The overtime rules affecting California’s food and alcohol/beverage service industries are described in Industrial…

Paid time off and vacation policies

Last Updated/Reviewed: 2025

Employers often provide paid time off (PTO) or paid vacation time to their employees to help recruit…

Restaurant Lease Guide for Business Owners

Last Updated/Reviewed: 2023

There is a lot of capital required to run a restaurant, and one of the main costs associated with operations is your physical space. However, before signing any lease, whether…

Retention period requirements for preservation of records

Last Updated/Reviewed: 2025

Below is a summary of the record-retention requirements for sales and use tax, federal and state income tax, federal and state employment tax…

Service charges definition and guidelines

Last Updated/Reviewed: 2025

In a ruling issued in June 2012, the Internal Revenue Service clarified the difference between a tip and a service charge for…

Sexual Harassment: An employer’s guide

Last Updated/Reviewed: 2024

In today’s current climate, sexual harassment has become a prevalent and prominent topic of discourse …

Smoking and the hospitality industry

Last Updated/Reviewed: 2023

California continues to set national and worldwide precedent in prohibitions on indoor and outdoor smoking…

Social Security Administration – Employer Correction Notices

Last Updated/Reviewed: 2024

In Spring 2019, the Social Security Administration (SSA) announced that it will begin to issue Employer Correction Request (EDCOR)…

Split Shifts: What are they and how to handle and calculate split shift pay

Last Updated/Reviewed: 2024

A “split shift” is defined as a “work schedule which is interrupted by non-paid, non-working periods established by the…

State and Federal government agencies that regulate your restaurant

This Report discusses the functions of state and federal agencies which promulgate critical regulations impacting our industry and…

The dos and don’ts of denying service and enforcing house rules

Last Updated/Reviewed: 2023

Restaurants may implement neutral patron conduct rules, dress codes or other neutral admission policies…

The dos and don’ts of interviewing and hiring

Last Updated/Reviewed: 2023

All too often, the restaurant industry suffers from “warm body syndrome.” Due to the pressures of this business, food service…

Mental Health Issues

Last Updated/Reviewed: 2024

Mental illness has been stigmatized in society. Until recently, and to avoid being singled out, judged or marginalized…

Tip reporting requirements

Last Updated/Reviewed: 2023

In August 1982, Congress enacted the Tax Equity and Fiscal Responsibility Act of 1982 (TEFRA), one of the most far-reaching tax laws in…

Tips defined and guidelines

On June 20, 2012, the Internal Revenue Service (IRS) issued Revenue Ruling 2012-18 to clarify and update existing guidelines on taxation…

TRAC tips: How the tip rate alternative commitment works

Last Updated/Reviewed: 2023

Effective June 1995, the Internal Revenue Service (IRS) instituted a new program, Tip Reporting Alternative…

Transgender Individuals, Gender Identity & Expression at Work

Last Updated/Reviewed: 2025

Restaurant owners, managers, and even employees have an obligation to uphold California’s anti-discrimination and accommodation…

Understanding and guidance on surcharges and service fees

Last Updated/Reviewed: 2025

Restaurants can continue to use service fees, surcharges, automatic gratuities, and other similar fees in California as long…

Unemployment Insurance: Tips for protecting your Unemployment Insurance rates

Last Updated/Reviewed: 2023

Unemployment Insurance (“UI”) is an unavoidable cost that almost every employer is forced to endure. While employers cannot necessarily…

Uniforms: Guide to uniforms

Last Updated/Reviewed: 2024

Many restaurant operators are confused about uniforms. What they are? Who buys them? Who takes care of them? These…

Unionization and the workplace

Last Updated/Reviewed: 2025

In 2025, unionization remains a key concern for employers. In 2022, the NLRB reported the highest number of unionization…

Wage deductions and garnishments

Last Updated/Reviewed: 2025

With the exception of standard payroll tax deductions, the law generally prohibits an employer from deducting any wages from an employee’s paycheck…

Wage theft liability and enforcement of judgments on successor companies

Last Updated/Reviewed: 2023

In 2016 California expanded individual and successor liability for wage and hour violations and gave the Labor Commissioner direct authority…

Waiting time, on-call time and reporting time-avoiding liability

Last Reviewed: 2026

The Fair Labor Standards Act (FLSA) is the federal labor and employment law which governs the payment of wages to employees. The FLSA is enforced …

What California Restaurants Need to Know About Food Handler Cards after Passage of Senate Bill 476

Reviewed/Updated: 2026

Every year, California restaurants are asked to quickly comply with ever-changing rules, regulations, and mandates imposed at the…

What to do if immigration officials target your business

Last Updated/Reviewed: 2025

January 2025 started off with headlines across California and the United States that Immigrations and Customs Enforcement (ICE) could now go into schools, places of…

When the government comes knocking: Have your ‘house’ in order before an employment sweep

Last Updated/Reviewed: 2025

As many California Restaurant Association members are aware, various state and federal government agencies have…