Finance

New Legislation Requires a Retirement Plan on the Menu.

CalSavers, Retirement Plans, and Your Business

In 2016, the California legislature delivered up Senate Bill No. 1234 which laid the foundation for the new state-sponsored CalSavers retirement savings program for California workers. Under the new law, all California employers with at least five California employees are required to offer their California employees a retirement savings plan, either from the private market or by registering to participate in the new CalSavers program. All eligible employers must either register for CalSavers or opt-out by the required deadlines.

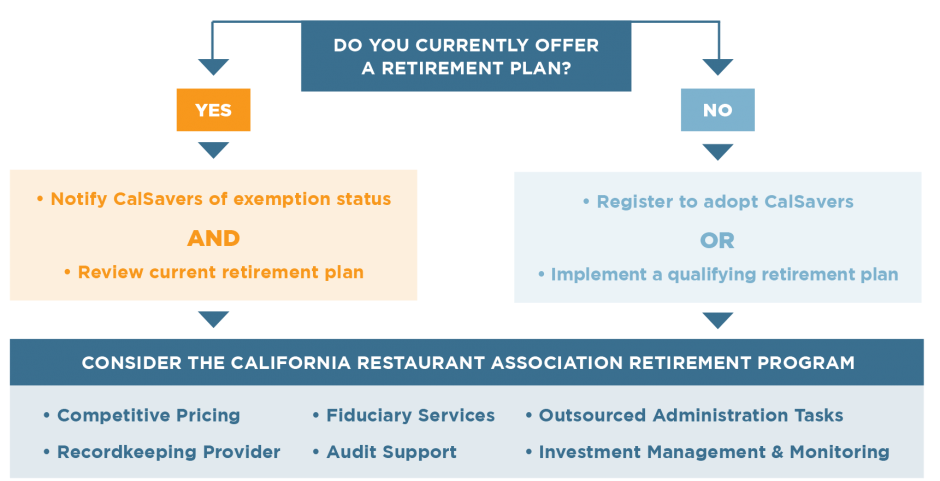

What are your options?

Determine if you are an eligible employer or exempt:

What are the CalSavers eligibility requirements?

California employers are required by state law to facilitate CalSavers if they don’t offer an employer-sponsored retirement plan and have five or more employees*.

All eligible employers can register at any time prior to their registration deadline.

- SEPTEMBER 30, 2020 | More than 100 Employees

- JUNE 30, 2021 | More than 50 Employees

- JUNE 30, 2022 | 5 or More Employees

*Your eligibility and compliance deadlines are based on your average employees throughout the year. This number is calculated by averaging the number of employees you report to the Employment Development Department on your previous four DE9C filings.

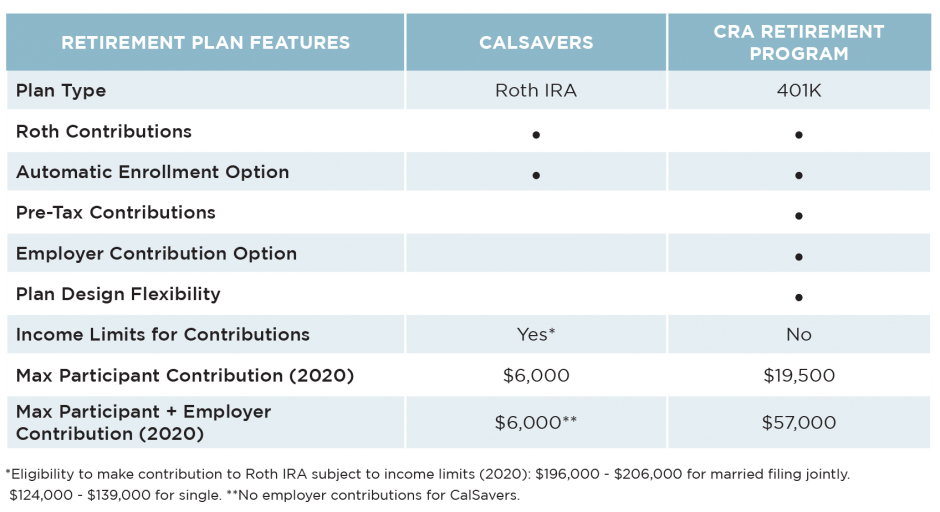

Retirement Plan Menu:

The Choice is Yours

visit california-restaurant-association.tagresources.com or

connect with Scott Tomei, CFP®, AIF®, MSFS | Senior Wealth Manager

2356 GOLD MEADOW WAY, STE 140, GOLD RIVER, CA 95670 | CA INSURANCE LIC #0D13657 | STOMEI@PWA-FINANCIAL.COM

CalSavers

Employer FAQ

What if I already offer a retirement plan to employees?

If you already provide a qualifying retirement plan to your employees you may initiate an exemption from registration with CalSavers by one of the following methods:

- Online Certification: employer.calsavers.com/home.html

- Phone Certification: (855) 650-6916

What is considered a qualifying retirement plan to be exempt from registering with CalSavers?

Qualified retirement plans include:

- Qualified pension or profit-sharing plans under 401(a);

- 401(k) plans;

- 403(a) plans;

- 403(b) plans;

- Simplified Employee Pension (SEP) plans;

- Savings Incentive Match Plan for Employees (SIMPLE) plans;

- Payroll deduction IRAs with automatic enrollment.

Does CRA offer any qualifying retirement plan options to members?

CRA provides the California Restaurant Association Retirement Program as an option for members wishing to adopt a qualifying retirement plan in lieu of registering for CalSavers. Members currently offering a qualifying plan are also encouraged to review the CRA Retirement Program as the program may provide added benefits and efficiencies compared to their existing plan.

Find out more about the CRA Retirement Program here: california-restaurant-association.tagresources.com

What are potential benefits of using the CRA Retirement Program?

The CRA Retirement Program provides the following potential benefits for members that currently provide a retirement and also members that are seeking to implement a new retirement plan:

- Transfer of administrative duties

- Fiduciary services

- Competitive pricing

- Recordkeeping services

- Bi-lingual support and technology

- Investment management and monitoring

- Recruitment and retention benefit

- Audit support

Are there penalties if I do not comply with CalSavers?

Yes. Per Government Code Section 100033(b), each eligible employer that, without good cause, fails to allow its eligible employees to participate in CalSavers, on or before 90 days after service of notice of its failure to comply, shall pay a penalty of $250 per eligible employee if noncompliance extends 90 days or more after the notice, and if found to be in noncompliance 180 days or more after the notice, an additional penalty of $500 per eligible employee.